Which Currency Pair Is Most Profitable In Forex 2022

Are you a trader looking to make the most profit in the forex market this year? With so many currency pairs available, it can be overwhelming to decide which one to focus on. But fear not! In this blog post, we will dive into the world of Forex and explore which currency pair is expected to be the most profitable in 2022. Buckle up and get ready for some exciting insights that may just help boost your trading game!

The Top 5 Currency Pairs to Trade in Forex in 2022

The forex market is a global system that allows traders to buy and sell currencies with the goal of making profits. Currency trading can be profitable, but it is important to understand which currency pairs are the most profitable in the Forex market.

In the year 2022, the most profitable currency pairs for forex traders will likely include the Japanese yen against the U.S. dollar, the Turkish lira against the euro, and the Chinese yuan against the U.S. dollar. These are all pairs where one currency is significantly stronger than the other, so traders can make profits by buying and selling these currencies simultaneously.

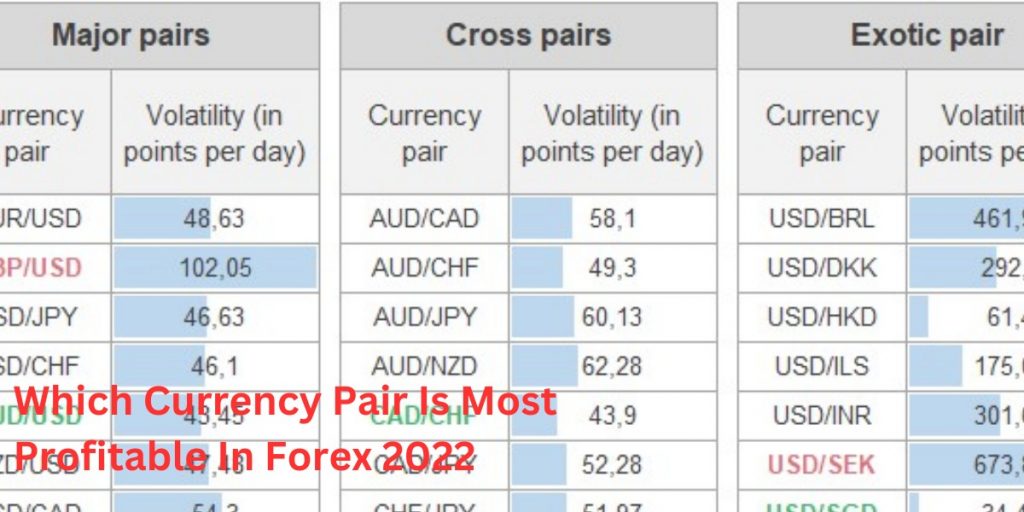

It’s also worth noting that some currency pairs are more volatile than others, so it’s important to research each pair thoroughly before starting to trade them. For example, the Brazilian real vs. The Japanese yen pair has a high volatility level, so it’s not recommended for beginning forex traders.

How to Trade the Top 5 Currency Pairs

There are many currency pairs that traders can choose from when trading in the forex market. However, some of the top five currency pairs that are most profitable to trade are the Australian dollar (AUD/USD), British pound (GBP/USD), Canadian dollar (CAD/USD), Japanese yen (JPY/USD), and Swiss franc (CHF/USD).

The Australian dollar and British pound are both considered to be strong currency pairs because of their relative stability compared to other currencies. The Australian dollar is relatively strong against the U.S. dollar while the British pound is stronger against the euro. The Canadian dollar and Japanese yen also have a strong relationship due to their respective economies.

The Canadian dollar is strong against the U.S. dollar while the Japanese yen is stronger against the euro and Chinese renminbi. The Swiss franc is a relatively weak currency pair, but it tends to rise when global stocks are down, which makes it a good option for those who want to take profits quickly.

Best Forex Trading Platform in the USA

Looking for the best forex brokers? Look no further than ex009! ex009 offers a wide variety of indicators, trend indicators, momentum, forecasts, volatility, volume, and more to help traders achieve profitable forex trading strategies. Whether you’re a beginner or an experienced trader, the ex009 library of tools will help you take your trading to the next level. So what are you waiting for? Sign up today and start profiting from the Forex market!

The forecasts section includes a wide range of forex prediction models, including linear regression models and neural networks. These models can help traders anticipate future events and exchanges rates movements. The volatility section provides real-time updates on currency prices throughout the day. This information can be used to make informed trading decisions.

What to Expect When Trading the Top 5 Currency Pairs

Trading the top 5 currency pairs can be profitable, but it’s important to understand the risks involved. Here are some things to expect when trading these pairs:

- Volatility will be high – This is always the case when trading forex. There is a lot of speculation and activity in the market, which means that prices can change quickly.

- Chance of loss is high – Like with any investment, there is a chance that you will lose money when trading forex. However, if you have a strategy and understand how to use technical analysis, you can minimize your risk.

- Price movements are unpredictable – Even if you have a well-planned strategy, the markets can still move in unexpected ways. This means that you need to be prepared for anything.

- Trade wisely – One of the biggest mistakes people make when trading forex is over Trading too much. If you don’t have an understanding of patterns and indicators, it’s easy to get carried away and end up losing more money than necessary.

- Have patience – The markets can move very quickly, so it’s important not to get too stressed out if things don’t go exactly as planned. Just keep calm and carry on with your strategy until it works out!